We recently replaced a large-cap Canadian bank with Laurentian Bank (LB) in Hamilton Capital Global Bank ETF (HBG), in order to reduce the ETF’s exposure to energy lending. LB has a 4.9% dividend yield and at the time of writing, trades at 8.4x f2016 earnings, or a ~20% discount to the Big-6 average. Investors familiar with LB might question the switch, as most are aware that the bank’s stock has historically underperformed its larger peers. In fact, this has been the case so far this year, with LB lagging the STDBNK index by over 500 bps – a material difference in just three months.

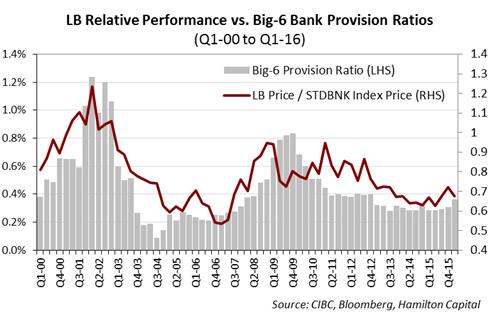

However, we suspect most investors are not aware that there have been distinct periods since 2000 during which LB has materially outperformed its large-cap peers. Those periods have encompassed periods of rising loan losses for the sector (notably, LB has underperformed during the recovery stage of a credit cycle). This dynamic is apparent in the chart below; LB’s relative outperformance/(underperformance) is greatest when provisions are rising/(falling).

Given loan credit losses are rising for the Big-6 (up ~20% in Q1) it is our view that the sector is entering a credit cycle. However, given this cycle is likely to be mild, potential outperformance by LB is likely to be more muted. That said, until there is more visibility on energy losses and reserve levels, we believe LB lowers the risk of HBG’s Canadian bank portfolio, by offering most of the positives of Canadian banks (high reliable yield, improving GDP in Central Canada), while – for now – offering minimal exposure to the more challenged areas, namely energy lending and fixed income trading.

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.