In the Hamilton Capital Global Bank ETF (HBG), we do not have positions in Citigroup (C), JPMorgan (JPM), or Bank of America (BAC), despite the fact that these banks are very inexpensive trading near or below TBV. Their lower valuations are directly linked to the fact their ROEs remain below their cost of capital. Just how low is profitability for these three mega-cap banks? ROEs in full year 2015 and Q1-16 remain very weak at: 7.9%/6.2% for C, 10.2%/8.9% for JPM, and 6.3%/4.1% for BAC. Therefore, while it is true these banks trade at or below TBV, it is also true that it will be extremely difficult for them to benefit from absolute multiple expansion until their ROEs rise. And given the intense earnings headwinds this looks difficult, meaning buying these banks on the expectation of rising ROEs is problematic.

Here are five reasons we don’t own these three banks.

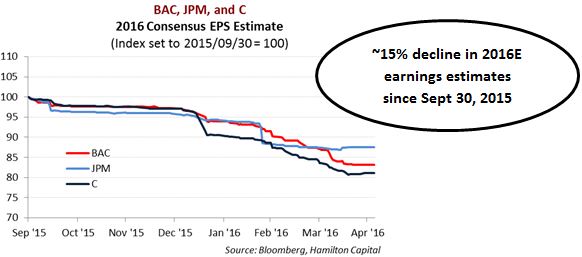

First, the banks have low dividend yields, and one of the objectives of HBG is to generate quarterly distributions — the current yield of the underlying portfolio is ~3.5%. By contrast, JPM and BAC have dividend yields of 2.9% and 1.4%, respectively. C’s dividend yield is one of the lowest in U.S. banking at 0.5% (although, likely to rise). Second, as the chart below shows, pressure on earnings forecasts has not abated. Consensus 2016E estimates have already been reduced 15% (on average) for the three banks since last fall, as global investment banking continues to struggle and credit costs in energy rise.

Third, these mega-caps have significantly less interest rate sensitivity than their regional and, especially, mid-cap peers. Fourth, unlike the mid-cap U.S. bank peers (i.e., assets less than US$75 bln), which continue to consolidate, there is no M&A theme for the mega-caps (two are above their statutory domestic deposit cap). And fifth, regulatory risk remains high; new unexpected regulatory issues continue to pop up (note, the recent CFPB proposal to allow class action lawsuits against financial services companies).

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.