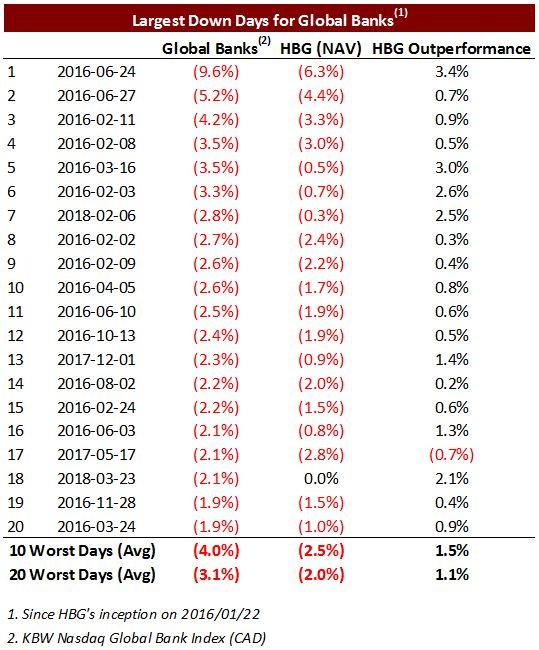

Hamilton Capital Global Bank ETF (HBG) continues to enjoy material outperformance with comparatively low drawdowns. Since inception, it has reported a 19% annualized return and is 14.4% ahead of the global bank index (in CAD, as of April 30, 2018).

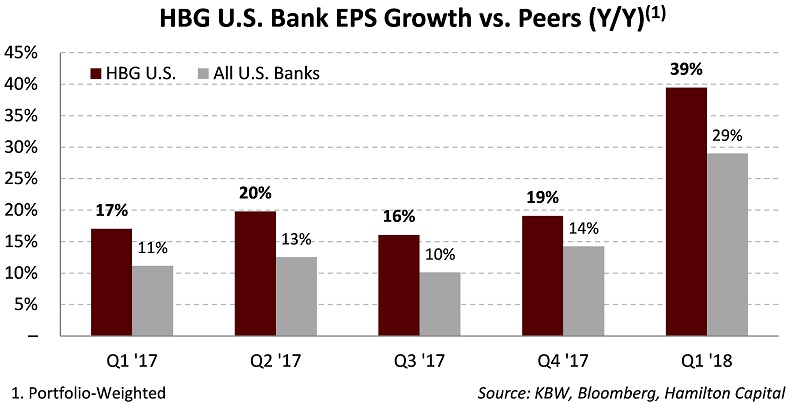

One of the main contributors to the strong performance of HBG is the earnings growth of the U.S. bank portfolio. In Q1-18, this portfolio reported yet another strong quarter, with year-over-year portfolio-weighted EPS growth of 39%, its 8th consecutive quarter of double-digit Y/Y growth. This is approximately 10% higher than the overall U.S. banking sector, which reported year-over-year EPS growth of 29% (see chart; source KBW). We would – roughly – estimate that EPS was 15% higher as a result of the reduction in corporate taxes, meaning that excluding this large, one-time contributor to EPS growth, portfolio-weighted EPS growth for HBG was closer to 24%, while the overall sector was closer to 17%.

Importantly, this was the 8th consecutive quarter where the U.S. banks in HBG grew materially faster than the sector. Contributing to this superior EPS growth was greater rate sensitivity of the portfolio in the form of margin expansion and robust volume growth supported in part by a favourable geographic footprint.

HBG also had comparatively low drawdowns during the two large macro corrections (Brexit and Yuan devaluation) and outperformed in 19 of the 20 worst days since its inception (see exhibit below).

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.