In this comment, we discuss the seemingly large gap between economists’ growth expectations for the global economy and those of the market. The former is forecasting comfortably positive growth, while the latter’s worries have prompted a global sell-off in equities. We also address the most likely trigger of a global downturn, while reviewing the impact of the European sovereign debt crisis.

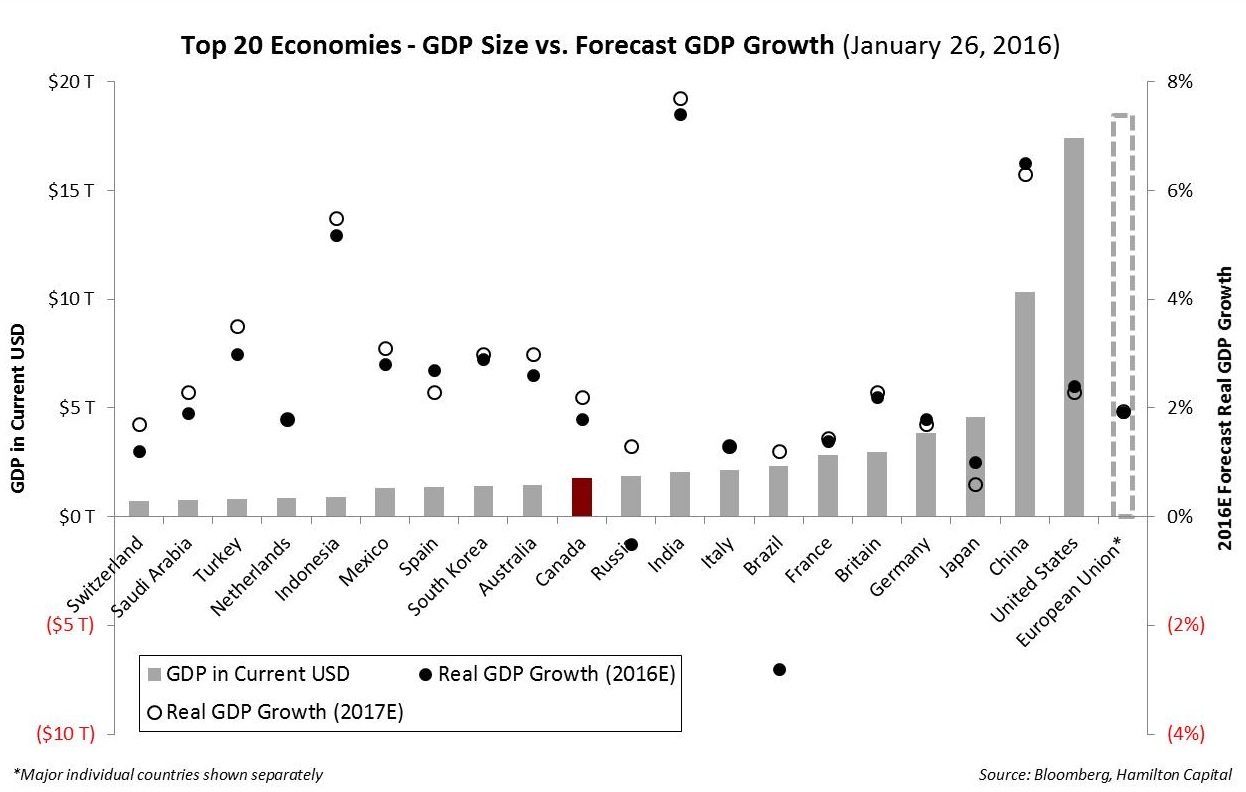

- Big Gap Between Economist’s Expectations and the Markets: The chart below depicts gross domestic product (GDP) for the major global economies ranked by size of economy (rising from left to right), representing the bulk of global GDP. Also depicted are economist forecast growth rates for 2016 and 2017 (indicated by dots). In general, the risk of a global recession falls/(rises) as the preponderance of “dots” moves to the top right/(bottom right) of the chart (i.e., largest economies). Economists forecast the largest economies to grow at levels well above recessionary levels. Although the market has traded off materially – led by the financials – the chart would suggest there is a large cushion between what the economists forecast and the view of some market participants that the global economy is headed to a recession.

- If Global Recession Arises, A Macro Event Will Likely be the Trigger: Given the relative insensitivity of GDP to large, rapid changes, it would seem to suggest that for global growth to enter a recession, it would require a very large drop off in U.S. and European economic output, since they account for nearly half of global economic output (i.e., ~US$36 trillion of ~US$77 trillion). A large drop off in GDP in China – to the extent it occurs – would have to be highly material to offset the growth in the other larger economies, given, at ~US$10 trillion, it represents ~15% of global economic output. Therefore, for the global economy to enter or even approach a recession, a significant macro shock would likely be required, with widespread effects on multiple economies, including the U.S. By definition, macro events are unpredictable. However, the rapid/disorderly devaluation of the yuan, and any spillover into the emerging markets, is (currently) the market’s biggest worry.

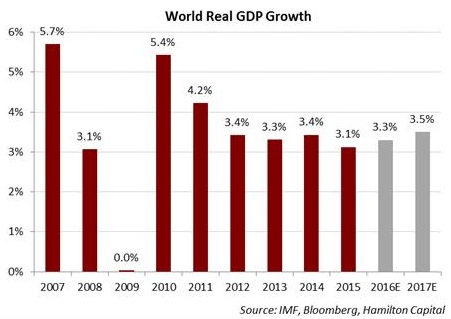

- Worth Noting: European Sovereign Debt Crisis Did Not Cause a Global Recession: To highlight the relative insensitivity of nearly US$80 trillion of global GDP to regional crises, we would reference the European sovereign debt crisis; in 2010/2011, the crisis arose within the epicentre of one of the largest economies in the world, yet it did not cause a global recession. That said, as the chart below highlights, global growth did decline from a very high 5.4% in 2010 (bouncing off a ~0% rate in 2009), to 4.2% in 2011, and closer to the global norm at a still comfortably positive 3.4% in 2012 (source: IMF).

In fact, it is even worth noting that not only did the European sovereign debt crisis not cause a global recession, it did not cause a recession in half of Europe’s top 10 economies, including the U.K. and France[1] (using the short-cut definition of two consecutive quarters of negative GDP growth). To be clear, the so-called GIIPS countries experienced a very severe compression in their GDP, but these five countries account for less than 25% of total European GDP. In fact, while European GDP declined materially from 2011 to 2012 as the crisis grew, it rebounded in 2013.

Notes

[1] Other larger European countries that didn’t experience a technical recession are Switzerland, Sweden, Norway, and Poland.