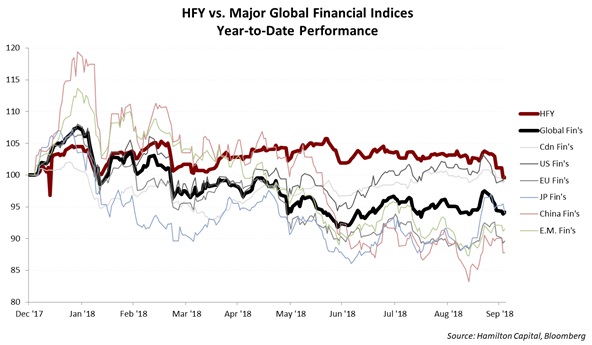

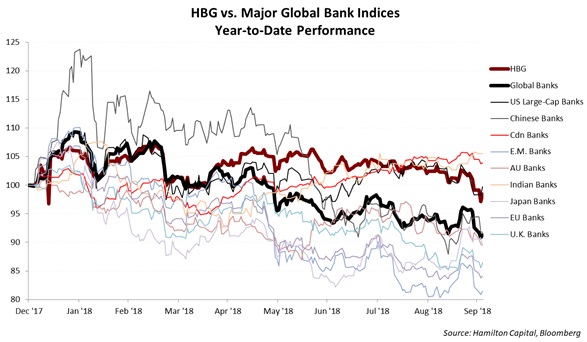

Despite a very challenging year for global financials/banks, the Hamilton Capital Global Bank ETF (HBG) and Hamilton Capital Global Financials Yield ETF (HFY) are both outperforming their benchmarks, as well as virtually all relevant country indices year-to-date. In fact, with concerns over global trade, emerging market volatility, European politics, and the shape of the yield curve, virtually all relevant global financials and bank indices are down materially led by Europe and Asia (Canadian and US financials also remain under pressure).

Notwithstanding the market’s concerns over various risks, the underlying fundamentals and EPS growth for the portfolio has been very positive. For example in the last quarter, portfolio weighted EPS growth for HBG and HFY was 21.9% and 17.3%, respectively. Portfolio weighted consensus EPS is forecast to remain very healthy at 20.7% for HBG and 17.5% for HFY in Q3-18.

As the chart below underscores, HBG and HFY continue to protect capital in a challenging market with returns well above the most important global indices, many of which have declined between 10% and 15% year-to-date.

The two charts below show Hamilton Capital Global Bank ETF (HBG) and Hamilton Capital Global Financials Yield ETF (HFY) relative to global indices. To highlight just how difficult the environment has been for the global financials/banks – and just how well HBG and HFY have performed – the charts below show year-to-date performance (as of October 4th). The charts below highlight resiliency in the face of challenging markets with HFY outperforming every major country’s financial sector index, and HBG outperforming all but two country indices (one being India).

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.