We recently attended Bank of America Merrill Lynch’s 2016 Insurance Conference in New York, where we took in presentations by 27 insurance companies, with representatives from the life, property and casualty (P&C), reinsurance and mortgage insurance sub-sectors. Most of the companies presenting were U.S.-based (and listed), with several Bermuda and Europe-domiciled reinsurers, and a Canadian P&C insurer also in attendance. Notwithstanding the location of their headquarters, most of the companies have some international exposure.

The common element shared by the various sub-sectors is financial risk. In one form or another, an insurance policy is entered into to reduce the financial risk of some event. Thereafter, the elements central to the pricing of and reserving for a particular policy vary by the risk it is trying to avoid. Hence, the most common elements discussed at the conference varied by sub-sector.

Highlights

- Ultimate form/impact of DoL fiduciary standard unknown, but market interpretation thought to be overly punitive: The Department of Labor’s proposed rule to address conflict of interest as it relates to investment advice provided to retirement plan officials/participants has weighed on variable annuity issuers, as the market has worried about the possibility of weaker sales/profitability. Affected presenters indicated the change would be manageable and that the market has failed to recognize possible ways to mitigate the longer-term impact.

- Is the P&C underwriting cycle “dead”?: P&C insurance typically exhibits a cycle of higher/lower prices and lower/higher losses. Consensus was that the cycle will continue but that the volatility of underwriting results will be more muted going forward, largely because better data has improved the underwriting process.

- Reinsurance pricing still under pressure: A surplus of capacity/capital (particularly in catastrophe) as alternatives (hedge funds, pension funds) have entered the reinsurance market has placed pressure on prices in recent years. Expectations for pricing to flatten-out in Q4 did not materialize as planned.

- Mortgage insurers (MIs) optimistic about prospects, work with the GSEs: In addition to favourable demographics (more people with less than 20% down-payments), the MIs were optimistic about opportunities to work further with the GSEs, namely in their ability to offer deeper coverage (insuring the first 50% of the loss instead of the current 30%). The added risk will likely mean greater use of reinsurance and capital markets going forward.

- Credit migration (not losses) expected in the energy part of the investment portfolios; impact expected to be “manageable”: Most lifecos indicated that 90%+ of their energy holdings were investment grade, and that they expected to see some credit migration within their portfolios, but all indicated that the shift would be “manageable”.

- Capital plans vary, but sell-off has made buy-backs more attractive: With stock prices for the companies we saw during the conference down 16% on average from the first of December through February 9, it was not surprising to hear most indicate that buybacks are likely to be the primary outlet for capital deployment. While M&A was discussed, most indicated that it was not a priority.

Ultimate form/impact of the DoL’s proposed fiduciary standard unknown, but market interpretation thought to be overly punitive

Last April, the Department of Labor (DoL) proposed a rule to address conflict of interest as it relates to investment advice provided to retirement plan officials/participants, as well as investors in individual retirement accounts. The rule includes certain variable annuities[1] (VA), hence VA issuers continue to field questions on its possible impact.

Although the final form is not yet known (now expected in late March), all presenters affected indicated the change would be ‘manageable’ and the additional transparency would ultimately be good for the industry. In at least one case, management felt the market’s perception of the impact was overstated, as it failed to recognize possible ways to mitigate the longer-term impact (for example, the shifting of offerings toward fee-based products, a process which has already started), even if shorter-term sales might see a decline. Another executive speculated that they could benefit from dislocations elsewhere, as they already have a compliant product that is well-known in their channels.

Is the P&C underwriting cycle “dead”?

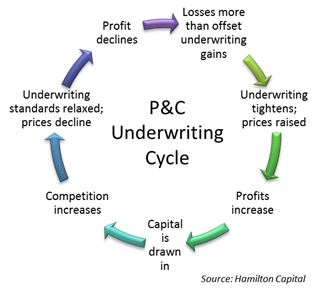

Like credit cycles in banking, P&C insurance typically exhibits an underwriting cycle (see chart). The cycle begins following large losses which tend to lead to a hardening market (i.e., higher prices, which translate into higher profits). Higher profits attract capital/competition, which then leads to a softening market (looser standards, lower prices). When losses overwhelm the remaining profits, the cycle begins again.

In response to the question, “is the P&C cycle dead?”, consensus among the presenters was “no”. However, all indicated that they expected the volatility of underwriting results to be more muted in the future.

Why? A combination of factors, but most importantly, better data and analytics are viewed to have improved the underwriting process. One executive was careful to caveat that long tail exposures (where claims can take a long time to materialize and settle; for example, worker compensation) are harder to predict, while another warned that data can be wrong.

Reinsurance pricing still under pressure

Consensus was that reinsurance is still seeing pricing headwinds. A surplus of capacity/capital (particularly in catastrophe insurance, i.e., hurricanes, floods, etc.) as alternatives (hedge funds, pension funds) have entered the market has placed downward pressure on prices in recent years. Expectations for pricing to flatten-out in Q4 did not materialize as planned, said one presenter, who indicated rates declined double-digit in Europe and single-digit in the U.S. While one executive indicated that he would “rather be the buyer than the seller” currently, another indicated that any idea that reinsurers are writing money-losing business is not realistic; “reinsurers aren’t going to take losses knowingly”.

Mortgage insurers optimistic about prospects, work with the GSEs

The one panel discussion at the conference focused on mortgage insurance, with executives from three mortgage insurers (MIs) participating. The conversation focused primarily on trends in the sector today.

Generally, the group was optimistic about opportunities for the industry. One executive indicated that demographics are working in their favour, as more people are entering the housing market with less than 20% down payment. Other opportunities relate to the government-sponsored enterprises (GSEs, i.e., ‘Fannie Mae’ and ‘Freddie Mac’, which hold close to US$5 trillion in residential mortgages). All noted that there is still a lot of discussion about the future of the GSEs, but that they expect the GSEs will be still around 3-5 years from now, notwithstanding their shrinking footprint[2]. The feeling was that the government will need to play a role in the mortgage market as long as 30 year fixed rates mortgages are available, but that perhaps that role should be limited to a catastrophic scenario. The GSEs have already been partaking in credit risk transfers, including deeper MI cover (namely, the MI insures the first 50% of the loss instead of the more traditional 30%). Additional risk taken by the MIs makes the longer term use of reinsurance and capital markets more likely, something the P&C reinsurers have shown interest in (given the higher margins and diversification benefits from their other lines).

Nonetheless, the executives agreed that the industry needs to demonstrate that it can maintain underwriting discipline and be smarter about dealing with risk, exposure and capital management in another downturn. As one executive said, lenders are very disciplined in the current environment, but eventually someone will try something risker – the onus will be on the MIs to not follow suit.

Credit migration (not losses) expected in the energy part of the investment portfolios; impact expected to be “manageable”

Given the pressure in the energy sector, the life insurance companies’ exposure to the sector (via their investment portfolios) was one of the most consistently asked questions at the conference. Most companies asked indicated that 90%+ of their energy holdings were investment grade. While all said they expected to see some credit migration (i.e., downgrades in investments, rather than defaults/losses) within their portfolios, all indicated that the shift would be “manageable”. Only one company expected any credit losses. Nonetheless, that same company indicated that potential losses had already been taken into consideration in its capital planning.

Capital plans vary, but sell-off has made buy-backs more attractive

How companies planned to utilize their excess capital was an equally popular question. Several executives indicated that the conversation today was different than it would have been two months ago. With stock prices for the companies we saw during the conference down 16% on average from the first of December through February 9 (life insurers have fared worse, falling 25% on average, versus an average decline of 12% for the safe-haven P&C insurers/reinsurers), it was not surprising to hear most executives indicate that buybacks are likely to be the primary outlet for capital deployment.

Only MET said buybacks were off the table at present, owing to the fact it believes itself to be in possession of material non-public information as it plans the separation/spin-off of its U.S. retail (life and annuities) business, announced January 12, 2016.

While M&A was discussed, most indicated that it was not a priority. Moreover, consensus seemed to be that any acquisitions that did happen would be small, bolt-ons, with strategic (rather than financial) significance. One executive commented that in the P&C space – where M&A was hot both in primary and reinsurance in 2015 – voluntary M&A was likely over.

For reinsurers, a slow-down in M&A at the primary level would be welcome given it usually leads to a decline in business (as retention levels for the new, larger company go up); at the reinsurer level, M&A is viewed more opportunistically, as peers view as a chance to take advantage of dislocation (management distraction, underwriting teams become available).

Notes

[1] Variable annuities are comparable to segregated funds in Canada – i.e., they are like mutual funds with some form of guarantee attached.

[2] The caveat was that more significant change could come if an economic event occurred where the GSEs had to go back to the U.S. Treasury for any material amount of money.