In our Insight, “Canadian Banks – Are Falling Global Reserve/Capital Rankings Increasing Regulatory Risk?” (April 27th, 2016), we highlighted that on the most important capital ratio, CET1, the Canadian banks have an average ratio of ~10%, which is well below the average of ~13.5% for the banks in 35 “major” countries (ranking 34th out of 35). We also explained in that Insight that we believe the Canadian banks are appropriately capitalized, but that the sheer size of this difference is an important issue for investors, since it could mean regulatory risk for the Canadian banks is rising.

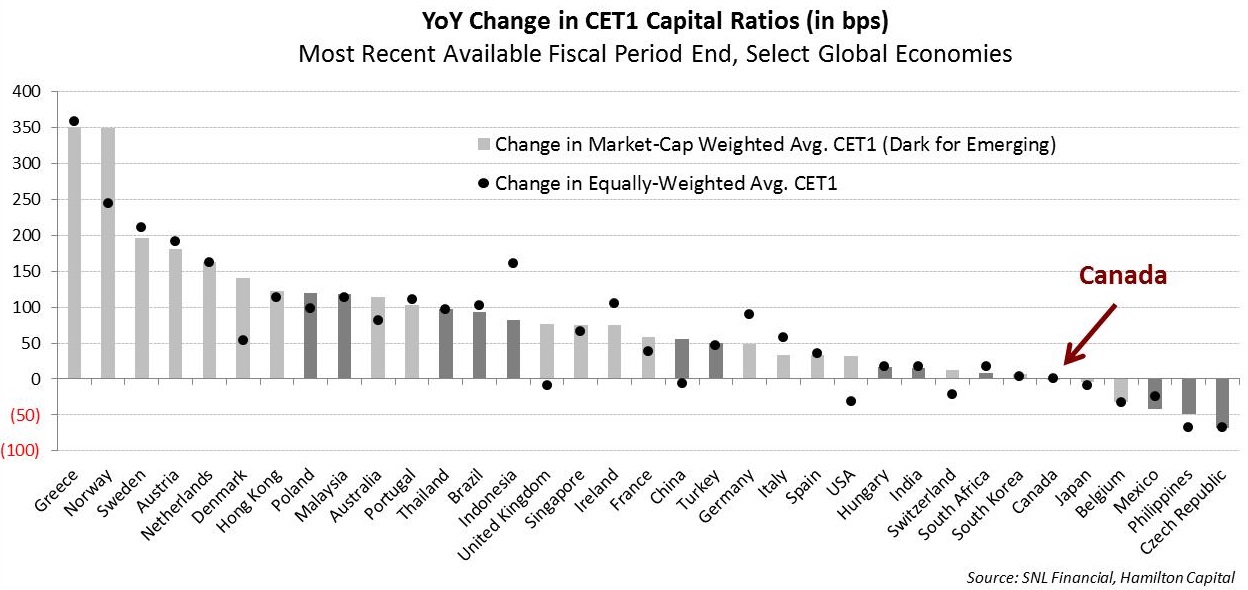

Also of importance, the Canadian banks continue to lose ground to their global banking peers on this metric (see chart below). Over the last year, the sector experienced zero growth in their CET1 ratios (actually declining by ~1 bps). This is in stark contrast to global peers, which had a year-over-year increase in this ratio of a very substantial 70 bps on average (see important footnote for explanation of differences in presentation)[1]. As the chart below highlights, virtually all global banks continue to build this ratio, underscoring its importance to investors/regulators.

Northern European banks continue to lead the way, with Norway, Sweden, and Netherlands experiencing some of the largest increases, raising their CET1 ratios by over 150 bps. Australian banks raised their ratios by a highly material ~100 bps, while U.K. banks increased their CET1 ratios by ~75 bps. U.S. and Indian banks saw their ratios rise a more modest ~30 bps and ~15 bps, respectively.

Our take: while we believe the Canadian banks are appropriately capitalized, if the global banks continue to grow this key capital ratio more than their Canadian peers, it is highly likely that the Canadian banks will face upward pressure, which could weigh on dividend and earnings growth (as it did for banks around the world in the post-crisis years).

The lack of focus/concern by investors of a sustained regulatory effort to narrow the CET1 ratio gap between the Canadian banks and their global peers remains one of the most significant – but generally undiscussed – issues facing the sector. It is also the most important takeaway from the quarter.

Notes

[1] The Canadian banks are shown on a market-cap weighted basis, using “all-in”/“fully-loaded”/“fully phased-in” capital requirements. The global banks are shown on a market-cap weighted basis, using “transitional” or “all-in”/“fully-loaded”/“fully phased-in” capital requirements, and include the largest publicly-traded banks in each country. For the global banks, data presented is “fully-loaded” or “transitional”, depending on availability by country / bank, with “fully-loaded” given preference if both sets of ratios are available, as it is the more conservative measure. The “all-in”/“fully-loaded”/“fully phased-in” basis of regulatory reporting includes all of the regulatory adjustments that will be required by 2019. Per Scotiabank, “Transitional requirements result in a 5 year phase-in of new deductions and additional capital components to common equity. Non-qualifying capital instruments are being phased-out over 10 years and the capital conservation buffer is being phased-in over 4 years.”