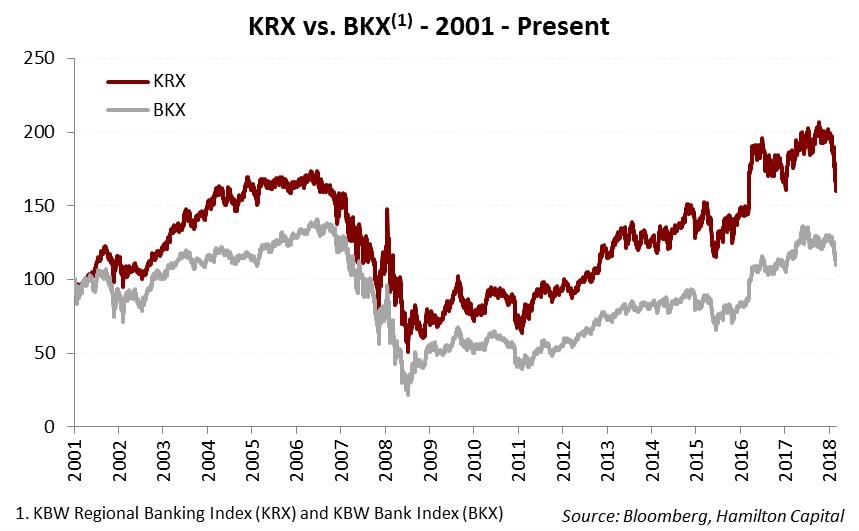

Given the media attention given to the U. S. large-cap financials (e.g., JPM, MetLife, AIG), Canadian investors can’t be faulted for sometimes neglecting to diversify into the very large and varied1 mid-cap financial sector south of the border. That said, in our view, investors should not overlook this important sub-sector given its long-term history of material outperformance relative to its better known large-cap peers, as evidenced by the chart below (comparing the performance of mid-cap (KRX) and large-cap BKX) banks2).

In fact, although the mid-caps have underperformed their larger peers since 2017 (despite superior EPS growth), they have outperformed in 10 of the last 18 years. And the last time the mid-caps underperformed for two consecutive years, they outperformed the large-caps by over 15% in the following year.

So what is the source of the long-term outperformance? In our view, the most important contributing factor to this outperformance has been the gradual consolidation of the U.S. financial sector. This trend began in the early 1980’s and we believe will likely persist at least for another ten years. It is one of the most attractive themes that we believe will impact the Hamilton Capital U.S. Mid-Cap Financials ETF (USD) (HFMU.U) in the next two years. In addition, we believe the ETF will benefit from higher growth from geographic customization (i.e., tilted to higher growth regions), as well as the greater rate sensitivity (of mid-caps, vs. their large-cap peers).

Note: Comments, charts and opinions offered in this commentary are produced by Hamilton Capital and are for information purposes only. They should not be considered as advice to purchase or to sell mentioned securities. Any information offered is believed to be accurate, but is not guaranteed.